How to Maximize Your Health Insurance Benefits

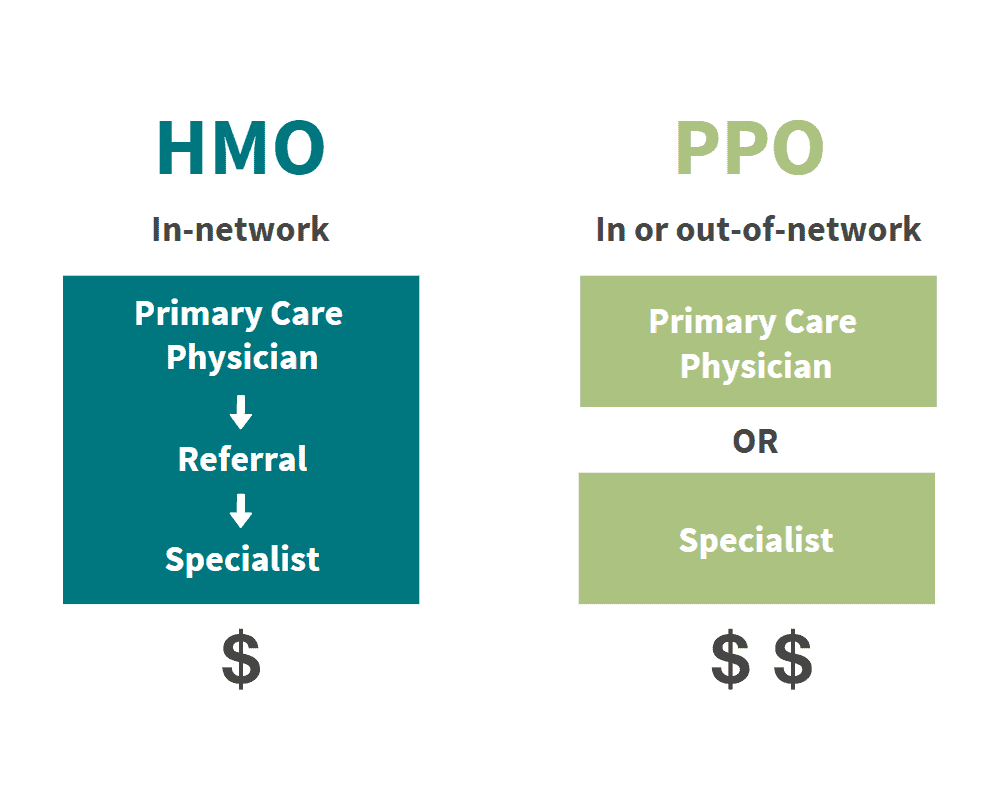

Health insurance is a critical component of managing your healthcare expenses and ensuring access to quality medical care. However, many policyholders struggle to fully utilize their health insurance benefits, missing opportunities to save money and receive comprehensive care. To get the most out of your health insurance plan, you need to understand your coverage, navigate … Read more